India imports 80-90% of its crude, making it one of the world’s largest net importers. That heavy dependence means every dollar jump in oil adds substantially to the country’s import bill and end‑consumer prices.

Just last week, the Reserve Bank of India

(RBI) lowered its inflation forecast for the financial year ending in March 2026 to 3.7%, down from 4%, and cut the repo rate by 50 basis points to 5.5%, citing falling food and crude prices. With May consumer price index (CPI) inflation at a six‑year low of 2.82%, the outlook had seemed hopeful. But that optimism could be short-lived.

As Nomura’s Robert Subbaraman pointed out, “The worst thing for the economies … is if this oil price continues to rise, and it’s a sustained rise, then that’s when it starts to impact economies, trade, especially Asia …”

“We currently expect two more rate cuts this year … but we’re watching what happens to oil prices closely,” he added.

Also Read: Crude oil spikes after Israel carries out airstrikes against Iran

However, not everyone sees this crude spike as a major disruptor.

Richard Redoglia, CEO of Matrix Global, believes the current oil spike is potentially short-lived. The structural oversupply may prevent any prolonged price surge unless physical disruptions become severe.

OPEC+, the lobby of oil producing nations, had announced plans to increase output. The decision was expected from the next meeting of the group scheduled in early July. The added supply would have brought prices down further but the latest escalation in the Middle East has dashed those hopes.

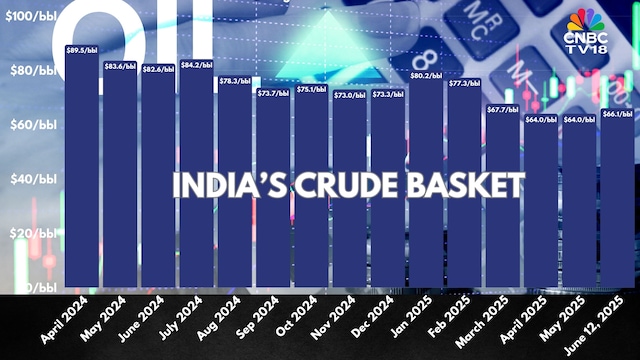

With the Indian crude basket now tracking a little over $66 a barrel, the rupee could weaken further (already hovering near ₹86), pushing up the cost of imports and straining current‑account and subsidy budgets.

Hitendra Dave, CEO of HSBC India, noted that while markets tend to react sharply to oil price movements, the actual economic impact may be more muted today than in the past. According to him, India’s oil intensity—how much oil the economy uses per unit of growth—has been falling steadily over the years. With GDP growing faster than oil demand, he believes the effect of rising crude on inflation and broader markets may not be as dramatic as many fear. “I would think this should blow over quickly from a financial market perspective,” he said.

In fact, Dave believes inflation could come in below the RBI’s projection, but the central bank is unlikely to react unless the gap is significant.

High inflation had stretched both consumers and borrowers for over a year until recently. Just when it seemed like the spectre of rising prices had passed, the shadow of another oil shock looms large over India.

“As of now, we are not changing our forecasts and continue to see CPI inflation undershooting RBI’s estimate of 3.7% to average much lower 3.3-3.4% in FY26,” said Madhavi Arora, chief economist at Emkay Global, while noting that every $10/bl increase in crude oil cost leads to annualised increase of 35 basis points in retail inflation.

Catch Israel-Iran War live updates here